Singapore is globally renowned as a business-friendly destination that offers a stable socio-political environment, free-market economy, highly efficient infrastructure, and an attractive tax regime.

As such, a primary advantage of Singapore is its ability to act as a centerpiece for the holding and management of regional assets. Holding companies are a vital component of any international expansion strategy, and Singapore offers investors a stable environment from which to administer operations in more speculative markets in Asia. The city-state has already attracted more than 37,000 international companies and 7,000 multinational companies that utilize Singapore as their regional headquarters.

Choosing your entity structure

Singapore’s efficient business environment is demonstrated by the ease with which foreign investors can incorporate a business in the country. Registering a company can take as little as one day provided all the files are in order.

Prior to establishing a company, investors need to decide the type of business structure that suits their needs. There are five types of business structures in Singapore:

- Sole proprietorship (one owner);

- Partnership (two or more owners);

- Limited partnership;

- Limited liability partnership; and

- Private company limited by shares.

Private company limited by shares

The private company limited by shares, commonly known as a private limited company, is the most preferred type of entity among foreign investors in Singapore. This entity is the most flexible, advanced, and scalable type of business form.

There are some key characteristics of a private limited company that makes them an attractive option for foreign investors:

A separate legal entity — the private limited company is a legal identity and separate from its shareholders and directors. Furthermore, this entity can also acquire assets, enter contracts, or enter debts in its own name.

Foreign ownership — this entity can be 100 percent foreign-owned.

Limited liability — the personal liability of the members that contribute towards the paid-up capital is limited to the amount that was contributed towards the paid-up capital.

Tax benefits and incentives — a Singapore private limited company is eligible for various tax incentives. For instance, the corporate tax rate of 17 percent is effective only for chargeable income above S$200,000 (US$147,000) with a 50 percent exemption on the next S$190,000 (US$139,000) of chargeable income. Furthermore, there is no capital gains tax.

Ease in the transfer of ownership — through the selling of all or part of the shares of the private limited company, the ownership of the company is transferred, thus not requiring any complex legal documents or processes.

A step-by-step guide to the corporate establishment

Incorporating a business in Singapore is efficient and cost-effective and can be broken down into several simple steps.

Step 1: Company name approval

The first step for foreign investors is to have their company name approved with the Accounting and Corporate Regulatory Authority (ACRA) — a statutory board under the Ministry of Finance responsible for the regulation of business activities, corporate service providers, and public accountants in Singapore.

Once a name has been proposed, the foreign investor should check if it has already been registered through the BizFile online portal as the proposed name cannot be identical to existing ones. Company names should also not be vulgar or offensive in nature. ACRA is usually swift with this process, often taking only a few hours to one day to approve. The only exception is if the business is in a field that requires a specific license, such as medicine, finance, and law. Also, the name application costs S$15 (US$11.02), which will be reserved for 120 days.

Step 2: Document preparation

Once the company name has been approved, the foreign investor can proceed with preparing the necessary documents for ACRA approval. These are:

- A Company Constitution, also known as the Articles of Association;

- The signed consent to act as a director by each director (at least one director must be a Singaporean citizen, permanent resident, or EntrePass holder);

- The registered local address;

- Signed consent to act as a company secretary (appointment must be done within six months after incorporation); and

- Details of each shareholder (can have between 1-50).

The company’s corporate service provider is obligated by ACRA to conduct a Know Your Customer (KYC) due diligence in accordance with the international Anti-Money Laundering Act to verify the documents as well those of the stakeholders involved in the company. If all documents are in place, step 2 can be prepared within one day.

Step 3: Incorporation

If the incorporation documents have been prepared, the company can be officially registered with ACRA. The process is done online and only takes one hour. Upon incorporation, the paid-up capital must be immediately paid and transferred into the company’s bank account. The minimum paid-up capital is at least S$1 (US$0.73).

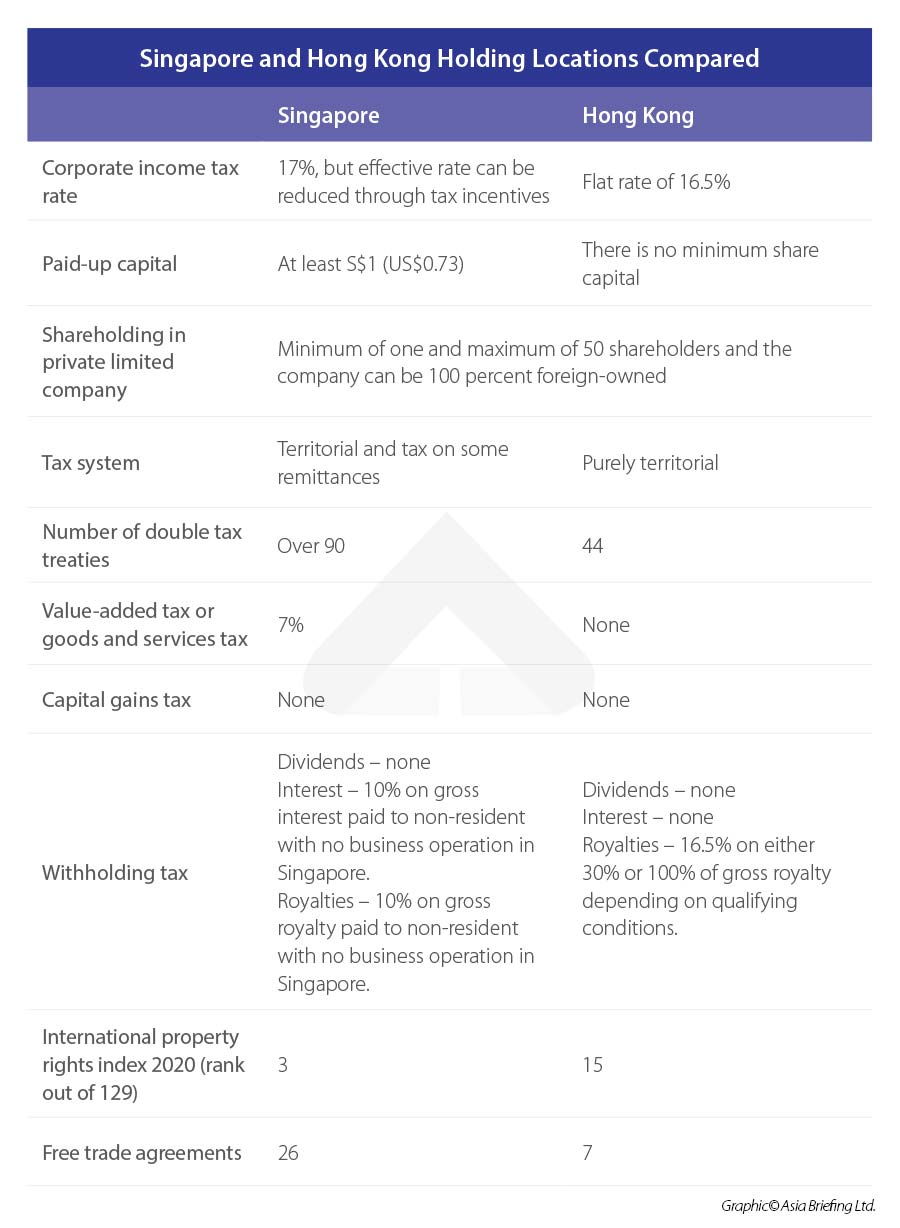

Singapore vs. Hong Kong

Hong Kong will continue to remain important for companies looking to tap the Chinese market, but Singapore will continue to serve as a magnet for multinationals that want to use the country’s innovation-led economy and generous investment and tax regime as a springboard for Southeast Asia.

For businesses that have not yet decided whether to target the market in China or Southeast Asia, Singapore is more likely to have a DTA or FTA that will benefit your business: Singapore has more double taxation agreements (DTAs) (90+) than Hong Kong (44), and more free trade agreements (FTAs) (26) compared to Hong Kong’s seven.

Benefitting from Singapore’s tax policies and free trade network

Singapore’s tax system is internationally recognized as efficient and competitive, which allows foreign investors to enjoy low tax rates and numerous tax incentives. The country operates a single-tier, territorial tax system, which means that foreign-sourced income would not face additional taxes in Singapore. There is also no capital gains tax and there is no tax on dividends.

Businesses can benefit from Singapore’s vast network of DTAs and unilateral tax credits, which further allows Singapore companies to reduce or eliminate taxes on their foreign-sourced income.

For individuals, Singapore is able to attract quality talent from around the world by offering low personal income taxes, and individuals can also reduce their effective tax rates through incentives offered by the government.

Meanwhile, Singapore’s extensive FTA, coupled with a transparent legal system and educated workforce, has been credited with accelerating the country’s transformation to a first-world economy.

The country’s 13 bilateral and 11 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

Overview of some important tax incentives

Singapore offers a multitude of tax relief measures to help businesses reduce their overall tax bills. Many of these incentives are for taxpayers involved in specified industries or sectors which are deemed essential to Singapore’s economy.

Applicants must generally carry out high-value activities in the country and will be required to commit to spending on local employment as well as certain levels of local business spending. Such factors include the capacity for the company to contribute to the growth of research and development (R&D), the potential for the business to create a spin-off to the rest of the economy, and introducing or anchoring leading-edge technology, activities, and skills in Singapore.

Common corporate tax relief measures to help reduce tax bills

Tax exemption for start-up companies

In 2005, the government introduced a tax exemption for start-up companies to support local enterprises’ growth and entrepreneurship. Qualifying companies are given the following tax exemption on the first three consecutive years of assessment (YA), where if the YA falls in 2020:

- 75 percent tax exemption on the first S$100,000 (US$73,646) of normal chargeable income (income to be taxed at the prevailing corporate tax rate); and

- A further 50 percent tax exemption on the next S$100,000 (US$73,646) of normal chargeable income.

The exemptions are open to all new start-ups except the following companies:

- Companies whose principal activity is that of investment holding; and

- Companies that undertake property development for investment, for sale, or for both.

Partial tax exemption for companies

Those not eligible for the tax exemption for start-ups can be eligible for the partial tax exemption scheme. Under this scheme businesses are afforded:

- A 75 percent tax exemption on the first S$10,000 (US$7,300) of normal chargeable income; and

- A 50 percent tax exemption on the next S$190,000 (US$140,000) of normal chargeable income.

Headquarter and internationalization incentives

International headquarters award

The international headquarter award (IHQ) provides businesses a concessionary tax rate of five or 10 percent on income for businesses that commit to substantive headquarter activities, such as managing, coordinating, and controlling their regional operations from Singapore.

Merger and acquisition scheme

The merger and acquisition (M&A) scheme provide the acquiring company an M&A allowance of 25 percent (capped at S$10 million (US$7.3 million) of the qualifying acquisition value capped at S$40 million (US$29.5 million) per year of assessment, stamp duty relief capped at S$80,000 (US$59,000), and double tax deduction transaction costs capped at S$100,000 (US$73,800).

Double tax deduction for internationalization

Under this incentive, the business can receive up to 200 percent tax deduction on expenses used for international expansion. Most DTDi deductions are subject to approval from Enterprise Singapore (ESG) and the Singapore Tourism Board. However, certain activities do not require approval on the first S$150,000 (US$111,000) of eligible expenses.

Incentives for manufacturing and services activities

Pioneer certificate incentive

The pioneer certificate incentive aims to encourage companies to develop and conduct new economic activities in Singapore. Eligible companies are eligible for a concessionary tax rate of five or 10 percent on income derived from qualifying activities. The incentive period is limited to five years.

Investment allowance

The investment allowance incentive is administered by the EDB, from which businesses can enjoy a tax exemption of up to 100 of fixed capital expenditure incurred.

The EDB defines fixed capital expenditure as expenditure incurred for qualifying projects within a five-year period, which can be extended up to eight years.

An extension of the 100 percent Investment Allowance (IA) scheme has been granted by the government until 2023.

The approved 100 percent IA support is capped at S$10 million (US$7.4 million) and is part of the Automation Support Package (ASP), which comprises the following grants, loans, and tax support. The ASP support itself is due to end on March 31, 2021, but the 100 percent IA scheme will still be available.

Incentives for finance and treasury activities

Finance and treasury center

Under this scheme, income derived from finance and treasury activities is taxed at a reduced rate of eight percent. Such approved activities include international treasury and fund management activities, investment and economic research analysis, and corporate finance and advisory services.

Financial sector incentive

The financial sector incentive, any income from high-value-added activities, such as transactions and services related to the equity market, derivatives market, and bond market, may be taxed at five percent, while other activities will qualify for a 13.5 percent tax rate.

Financial sector technology and innovation scheme

This scheme provides co-funding to develop financial technology (Fintech) that enhances Singapore’s banking industry. The scheme offers support of up to 70 percent for qualifying costs such as IP rights, technical software, manpower skilling, and professional services, among others.

Taking advantage of Singapore’s double tax agreement network

Singapore has one of the world’s most extensive DTA networks, attracting international businesses from a multitude of conventional and nuanced industries. The country has signed over 90 DTAs, which comprise of three types: comprehensive, limited, and exchange of information arrangements (EOIAs).

Comprehensive DTAs provide relief from double tax for all income types between the two signatories. Limited DTAs, however, only provide relief from income generated from air transport and shipping, and EOIAs are provisions for the exchange of tax information.

The tax reliefs under each DTA treaty differ for each country. They normally cover several income types:

- Tax on royalties;

- Tax on dividends;

- Tax on capital gains;

- Tax on interests;

- Shipping and air transport;

- Directors’ fees;

- Independent and dependent personal services;

- Researchers;

- Students; and

- Income from immovable property.

How to avail the benefits of a Singapore DTA

To benefit from Singapore’s extensive network of DTA’s, the individual or company must be a tax resident of Singapore or the other country.

A Singapore resident is defined as:

- A company or body of persons whose control and management of the business is exercised in Singapore; or

- An individual who resides in Singapore and who is physically present or who exercises employment in Singapore for 183 days or more in a calendar year.

The Singapore resident must submit proof of their Singapore tax residency — a certificate of residence (COR) — to the other treaty country. If, however, the company is a tax resident of the treaty country, they will need to submit a completed Certificate of Residence from Non-Residents certified by the tax authority of the treaty country to the Inland Revenue Authority of Singapore.

Within Singapore, a COR is used to establish a company’s eligibility for exemption on taxation of profits remitted from foreign operations in the form of foreign branch profits, dividends, and other foreign-sourced income. Without a COR, these remitted profits would be subject to the same manner that any other profits would be within the country.

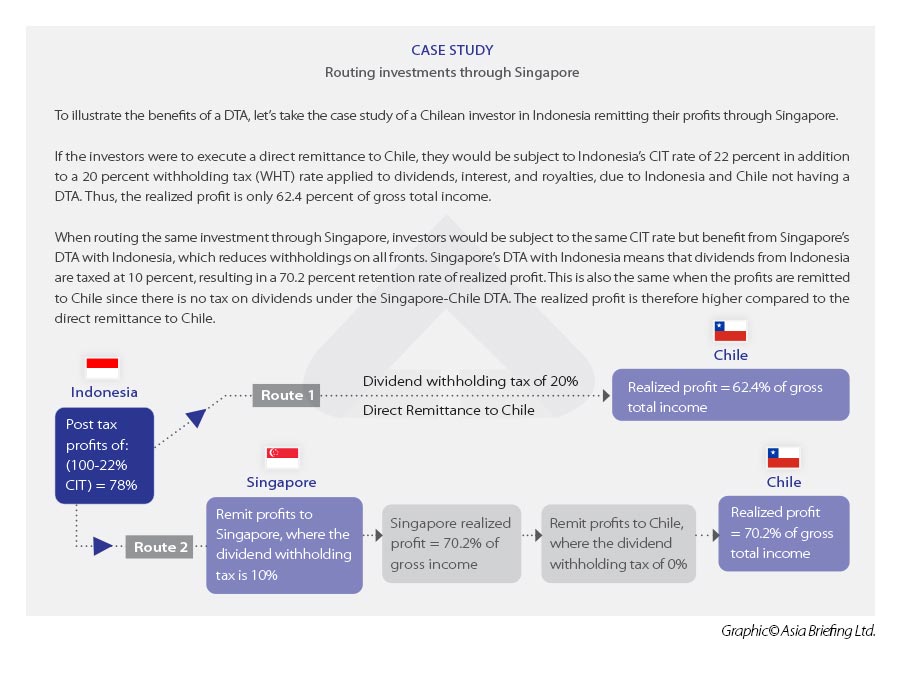

Case study: Routing investments through Singapore

To illustrate the benefits of a DTA, let’s take the case study of a Chilean investor in Indonesia remitting their profits through Singapore.

If the investors were to execute a direct remittance to Chile, they would be subject to Indonesia’s CIT rate of 22 percent in addition to a 20 percent withholding tax (WHT) rate applied to dividends, interest, and royalties, due to Indonesia and Chile not having a DTA. Thus, the realized profit is only 62.4 percent of gross total income.

When routing the same investment through Singapore, investors would be subject to the same CIT rate but benefit from Singapore’s DTA with Indonesia, which reduces withholdings on all fronts. Singapore’s DTA with Indonesia means that dividends from Indonesia are taxed at 10 percent, resulting in a 70.2 percent retention rate of realized profit. This is also the same when the profits are remitted to Chile since there is no tax on dividends under the Singapore-Chile DTA. The realized profit is, therefore, higher compared to the direct remittance to Chile.

Singapore’s free trade agreements

Despite regional players maintaining strong FTA networks, they are not as extensive as Singapore’s. Due to these factors, the country will continue to be the default location for businesses seeking to expand into Southeast Asia and neighboring regions.

The country’s 14 bilateral and 13 regional FTAs include some of the largest combined trade agreements in the ASEAN-China, ASEAN-India, and ASEAN-Hong Kong trade blocs — providing Singapore-based businesses with access to preferential markets, free or reduced import tariffs, as well as enhanced intellectual property regulations.

There are two types of FTAs: bilateral (agreements between Singapore and a single trading partner) and regional (signed between Singapore and a group of trading partners).

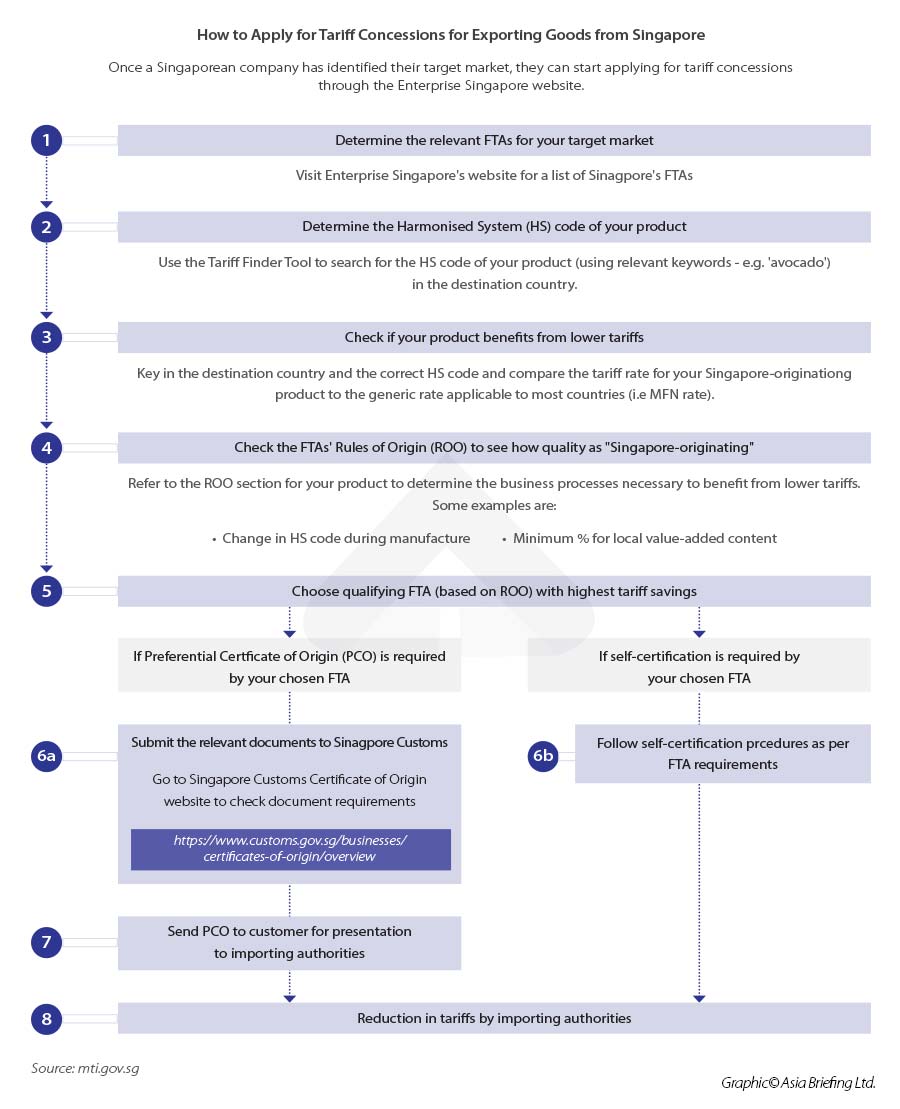

How to apply for tariff concessions for exporting goods from Singapore

Once a Singaporean company has identified its target market, it can start applying for tariff concessions through the Enterprise Singapore website.

By Ayman Falak Medina / aseanbriefing

The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the position of AsiaWE Review.