The Covid-19 crisis has stalled the delivery of much-needed climate finance to developing countries. For Southeast Asia, a region frequently cited as being one of the most vulnerable regions threatened by climate change, the broken promise of climate finance is highly disappointing.

INTRODUCTION

Climate finance has been one of the most contentious issues in global climate politics. At the 2009 United Nations Climate Change Conference (COP 15), developed countries committed to mobilising by 2020 US$100 billion climate finance annually to assist vulnerable countries. The pledge has been key to building trust between states to limit global warming to well below 2 degrees Celsius, as specified in the Paris Agreement.

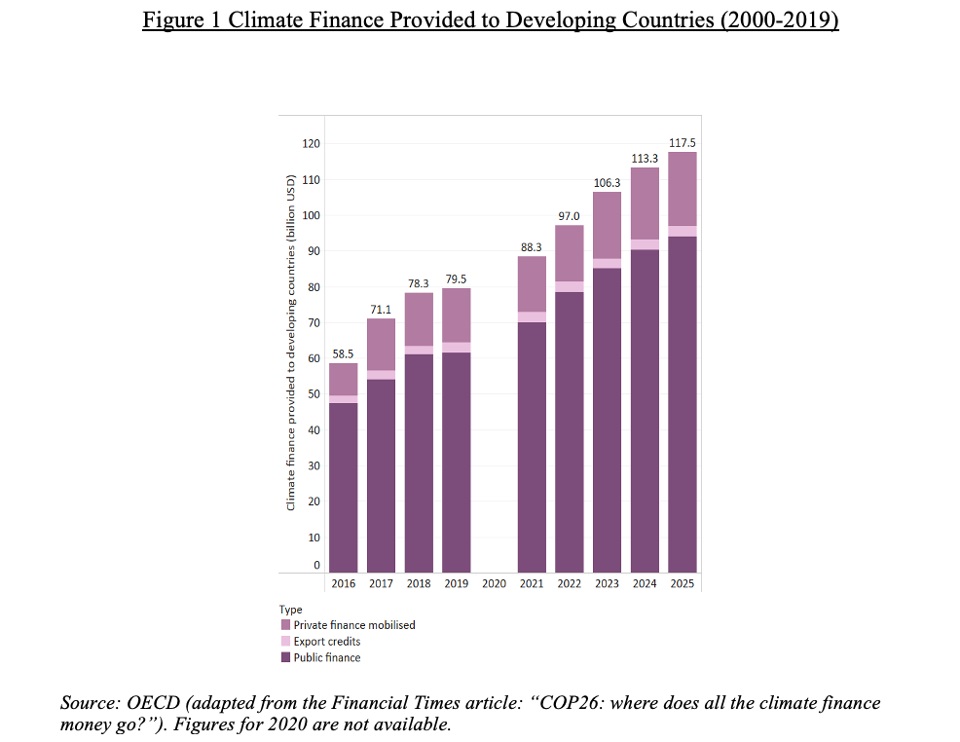

However, the spread of Covid-19 in late 2019 devastatingly halted the delivery of the pledge. A study by the World Resource Institute pointed out that international climate finance decreased during the pandemic. Even before the pandemic, climate finance had been falling short. As of 2019, climate finance reached only US$79.6 billion. The deadline has come and gone with the 2021 United Nations Climate Change Conference (COP 26) giving assurance that the target will be fulfilled by 2023, delaying the commitments by another three years, and undermining the credibility of developed countries and the overall progress in addressing the global climate crisis.

For Southeast Asia, a region frequently cited as being one of the most vulnerable regions threatened by climate change, the broken promise of climate finance is highly disappointing. In many climate summits and meetings with international partners, Southeast Asian leaders frequently seek assistance to enhance their fiscal capacities to fund their long-term climate goals, namely green infrastructure development, institutional strengthening, and extending climate assistance to the poor and vulnerable populations. In the most updated Nationally Determined Contributions (NDCs) to the UNFCCC, seven out of ten ASEAN countries, with the exception of Brunei, Malaysia, and Singapore, have set more ambitious carbon emission reductions conditional upon receiving international assistance from advanced economies.

This article gives an overview of international climate assistance distributed to Southeast Asian countries, provides key trends analysis and highlights gaps in climate assistance mobilised in the region from 2000 to 2019. Using data from the OECD Development Assistance Committee (DAC) on Official Development Assistance (ODA) and other resource flows to developing countries from bilateral and multilateral development cooperation, it analyses climate-related development finance data inflows to ASEAN countries. It further informs strategic directions for the regional policymakers and offers some considerations for future climate negotiations with international partners.

CLIMATE ASSISTANCE TRENDS IN SOUTHEAST ASIA

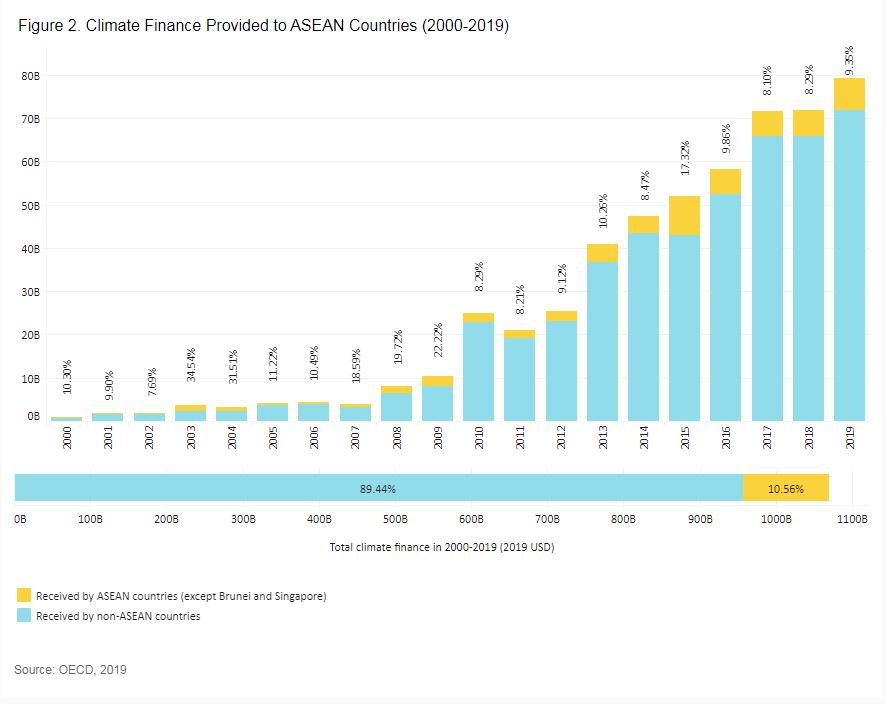

Trend 1: 10.56% of the Global Climate Finance went to ASEAN Countries

From 2000 to 2019, developed countries mobilised a total of US$ 533 billion in climate finance for developing countries. Thus, on average, nearly US$28 billion were given to developing countries in the past 20 years annually. The pledge made at COP 15 in Copenhagen was to provide an annual sum of US$100 billion in climate finance by 2020. In 2019, only US$79.60 billion was mobilised.

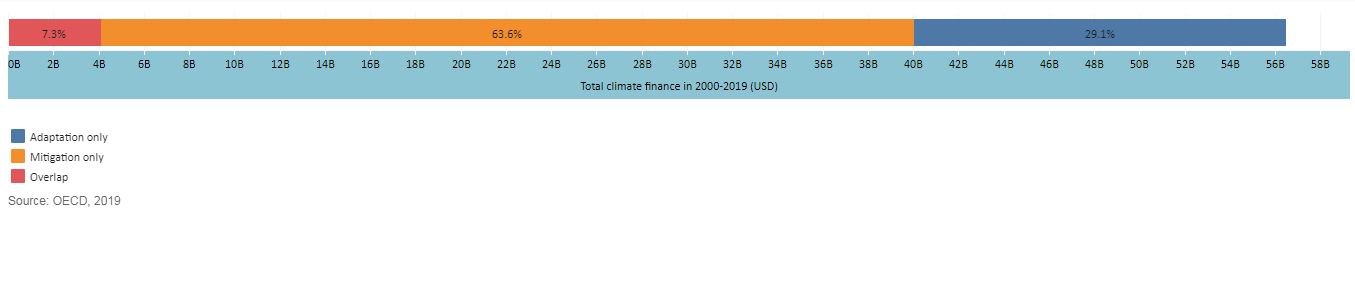

ASEAN countries (except Brunei and Singapore) received a total of US$56 billion or 10.56% of the total assistance between 2000 and 2019. On average, developed countries provided only US$86 per person in eight ASEAN countries over 20 years, or as little as US$4 per person annually.

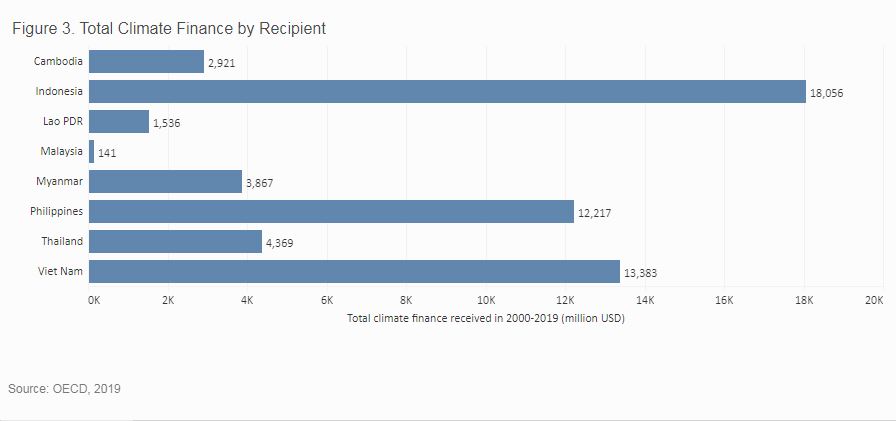

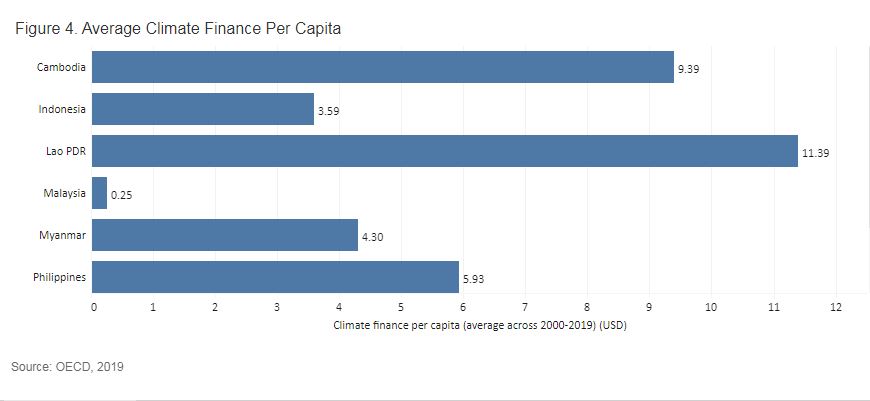

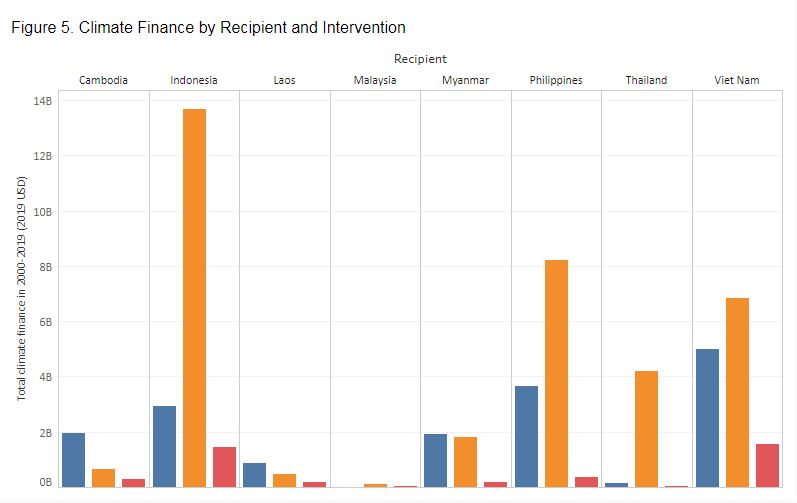

Trend 2: Indonesia, the Philippines and Vietnam are the Top Three Climate Finance Recipients in ASEAN

Of the eight ASEAN countries that were recipients of assistance mobilised by developed countries over the past 20 years, the three with the highest populations — Indonesia, the Philippines, and Vietnam – were the top recipients. However, Lao PDR, Cambodia, and Vietnam are the top three recipients of assistance received per capita. Cambodia and Laos are among the lowest per-capita GDP countries in the region. Meanwhile, Myanmar, the poorest country with a GDP per capita of US$1,250 received a relatively modest amount of climate assistance per capita over those 20 years of US$4.30 on average, compared to US$9.39 and US$11.39 for Cambodia and Laos respectively.

Trend 3: Lack of Climate Adaptation Finance in The Region

The Global Climate Risk Index developed by GermanWatch ranked four ASEAN countries, Myanmar, the Philippines, Vietnam and Thailand among the top ten countries most affected by extreme weather events from 1999 to 2018. Although Southeast Asia is frequently referred to as one of the most vulnerable regions to climate change, assistance on climate adaptation finance that can provide the region with the capacity to reverse effects of climate change such as floods, drought, and extreme weather, and to improve the resilience of vulnerable populations is still lacking.

The region received a total of US$28.37 billion in assistance to fund climate mitigation projects between 2000 to 2019. In comparison, it only received US$10.42 billion assistance to invest in adaptation capacities. Simply put, climate mitigation projects attracted almost three times as much funding as climate adaptation projects did.

Among ASEAN countries, Indonesia received the highest amount of climate mitigation assistance (US$13.7 billion), while Vietnam received the largest amount of climate adaptation assistance (US$5 billion).

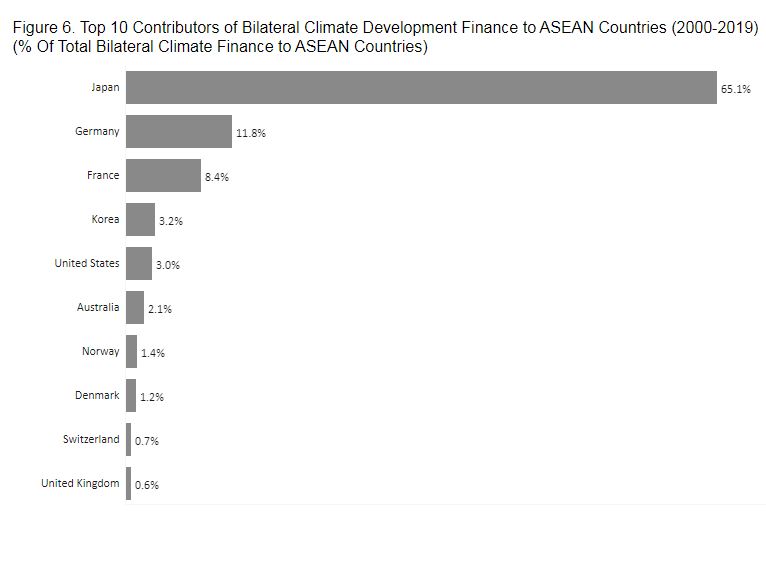

Trend 4: Japan is the Biggest Donor in the Region

The Japanese government is by far the biggest bilateral and multilateral donor in the region. The Japanese government provided 65% of total bilateral climate finance between 2000 to 2019, outstripping Germany’s 11.8% and France’s 8.4% contribution. Similarly, the Asian Development Bank (ADB), where Japan is the top contributor to the institution’s funds, provided 32.8% of the total multilateral climate finance. However, both donors’ contributions to the region were concentrated in Indonesia, the Philippines, and Vietnam.

The role of the Japanese government in assisting the region’s transition to a green economy is important for the region. In the Southeast Asia Climate Outlook 2021 Survey conducted by the ISEAS – Yusof Ishak Institute, Southeast Asians think that Japan is the second most trusted partner in helping the world achieve Paris-aligned goals and in sharing their climate expertise to the region, after the European Union. Interestingly, Japan’s climate leadership was polled as the first choice in the Mekong countries of Cambodia, Laos, and Myanmar, as well as in the Philippines.

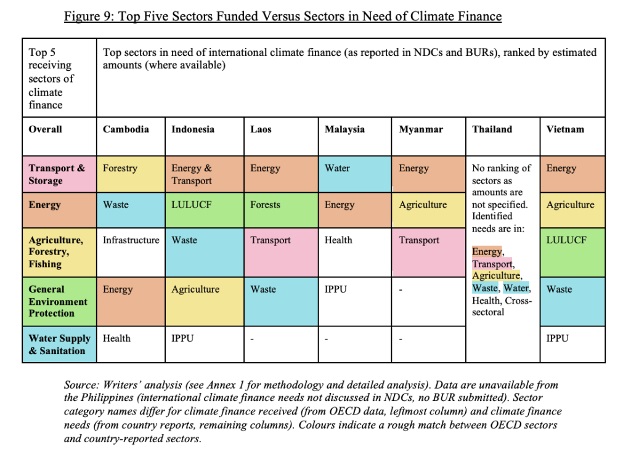

Trend 5: Transport & Storage, Energy, and Agriculture and Forestry, Fishing are the Top Three Most Funded Sectors in the Region

Transport and Storage, Energy, and Agriculture, Forestry, and Fishing are the top three most funded sectors in the region, receiving a total of US$17.6 billion, US$12.8 and US$ 6.1 billion respectively from 2000 to 2019. Meanwhile, adaptation-specific sectors, such as water supply and sanitation, disaster preparedness, and reconstruction and rehabilitation, albeit much needed, received less than US$5 billion each in the same period.

NDCs and Biennial Update Reports (BURs) submitted to the UNFCCC by ASEAN countries contain details of the amount of climate finance needed to achieve their Paris pledges. While some countries identified specific sectors where international financial support is needed, others have gone further to estimate the amount of finance needed for specific sectors and projects. Figure 9 shows comparisons between sectors and focuses on climate mitigation and adaptation finance received from 2000 to 2019 versus climate finance needs reported by ASEAN countries. In general, international climate finance has been channelled consistently to the priority sectors of ASEAN countries, although there is some mismatch.

For instance, Indonesia’s climate pledge highlighted the need to prioritise (1) Energy and Transport, (2) Land Use, Land Use Change and Forestry, (3) Waste, and (4) Agriculture. These four sectors received the highest climate finance provided by donors. Indonesia also articulated a commitment to slash carbon emissions from the Energy and Industrial Processes and Product Use (IPPU). However, this sector has yet to receive significant funding from donors. Similarly, Malaysia and Cambodia articulated their priority in enhancing their infrastructure and health sectors in response to climate change, yet these sectors have not garnered significant support from donors (see Annex 1 for detailed analysis).

Trend 6: Loans Comprise the Majority of Climate Finance in the Regio

There is yet to be a multilaterally agreed definition of climate finance; this is considered by some countries to be an obstacle in the proper accounting of climate finance. OECD’s definition includes grants, debt instruments, mezzanine finance instruments, equity and shares, debt relief, guarantees and other unfunded contingent liabilities in its estimates of climate finance. This led to an estimated amount of US$79.2 billion in global climate finance in 2019. The proportion of global climate finance delivered in the form of debt instruments increased from 14.91% in 2000 to 63.89% in 2019.

Focusing on the ASEAN-8 recipients, the proportion of finance in the form of debt instruments reached 85.5% in 2019, compared to 53.2% in 2000. The proportion of debt instruments shot up to 90.9% in 2003, and has stayed within 65% to 90% since. Mostly, debt instruments consistently made up over 80% of finance in 2015-2019. Of this debt finance, 0% was non-concessionary in 2000, compared to 48.62% in 2019. As such, the proportion of climate debt offered under more generous terms than market loans is decreasing steadily. Compared to the global context, climate development finance flows to ASEAN countries are more likely to be in the form of debt instruments such as standard loans, with similar rising trends in non-concessionary debt finance.

The Climate Finance Shadow Report 2020 conducted by Oxfam found that while reported public climate finance has increased over the years, this is largely due to the rise of non-concessional loans and other non-grant instruments, a trend which is also observed on the part of ASEAN recipients. The report highlighted that the grant equivalent of global reported public climate finance in 2017-2018 was just US$25 billion, less than half the face-value figure of US$59.5 billion in the same period. To avoid overstating international climate assistance, Oxfam urged countries to report the grant equivalent of their climate finance to the UNFCCC, which would provide an estimation of the amount of money given away in a concessional loan compared to a standard market loan. This practice has been adopted for development finance reported to the OECD since 2018.

The growing magnitude of debt instruments in overall climate finance is not surprising, given the rising popularity of sustainable finance globally and in the region, but this raises concerns of debt burden. The Jubilee Debt Campaign estimated that spending on external debt is over five times higher than on climate adaptation in lower income countries, bolstering developing countries’ argument that overwhelming debt restricts their ability to take climate action. Oxfam argues that some climate-financed projects may not be as profitable in low-income societies, which may have difficulty generating the revenue needed for repayments. The proportion of debt instruments in climate finance received by lower-income ASEAN countries can be seen in Figure 11.

Cambodia, Laos and Myanmar respectively received 60.5%, 46.7% and 74.7% of their climate finance in the form of debt instruments. This amounts to around US$1.8 billion, US$716.9 million and US$2.9 billion respectively, over two decades. Yet, the overall debt burden in these countries is already high. Between 2018 and 2020, Laos spent an average of US$509 million per year, Myanmar spent an average of US$492.3 million per year, and Cambodia spent over US$1billion per year on principal repayments. In the same period, the average ratio of external debt to Gross National Income was 63.7% for Cambodia, 94.0% for Laos and 16.0% for Myanmar.

Japan was the largest provider of climate finance to the ASEAN region in 2000-2019, contributing 65.1% of all bilateral climate finance received, while France was the third largest provider. Both are also among the largest providers of climate finance globally. In contrast to other major providers, almost all of Japan’s and France’s contributions are in the form of concessional and developmental debt (95.0% and 97.3% respectively). In contrast, Germany, Japan, the US and Australia were the largest providers of grant-based finance.

Recommendations

International climate finance is needed to enable developing countries to adopt more ambitious NDCs under the Paris Agreement. The climate finance mobilised by developed countries for ASEAN has highlighted several gaps and opportunities for future climate finance cooperation.

- The pledge to provide US$100 billion climate finance annually has yet to be achieved. Developed countries will be expected to provide more to keep this pledge in future climate negotiations. Data show that ASEAN countries (except Brunei and Singapore) received a sum of US$56 billion or 10.56% of the total assistance over 20 years. Further study is needed to evaluate whether the number or proportion is enough, given Southeast Asia’s projections of climate risks and the population numbers exposed to the risks.

- Most climate finance received in the region is in the form of loans. ASEAN governments should also be more articulate in determining to what extent loans can assist lower-income countries in climate action without adding to their existing financial burdens.

- The ASEAN region currently receives much bilateral and multilateral climate assistance from the government of Japan. Given the region’s investment attractiveness, ASEAN needs to better communicate their climate visions to other bilateral and multilateral partners so that they can play more critical roles in filling the financial gaps in the future.

- Although studies show that Southeast Asia is in dire need of climate adaptation, the region did not receive enough financial assistance on climate adaptation-related projects. Projects such as Nature-based solutions (NBS) and Reducing Emissions from Deforestation and Forest Degradation in Developing Countries (REDD+) have been attractive and proven bankable. Donors must continue mobilising funding for scaling and replication of these projects across the region. At the same time, ASEAN countries need to articulate better adaptation pledges as well as make adaptation investments bankable to attract more capital from other sources.

- Determining the instruments for climate action has been a contentious issue in many climate conferences. While economists and policymakers are still examining the prospect of various climate instruments, ASEAN governments must consider utilising a wide variety of instruments. Such an approach will help diversify financial sources.

- The analysis in Figure 9 suggests that some sectors are underfunded, such as infrastructure and health (Cambodia) and IPPU (Indonesia, Malaysia, and Vietnam). ASEAN countries need to articulate their climate finance needs more clearly in their NDCs, e.g. defining conditional and unconditional targets at sector level, identifying sectors that need climate finance, and estimating amounts needed if possible, so that international finance can better match their contribution to the Paris Agreement.

By Melinda Martinus & Qiu Jiahui / fulcrum

The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the position of AsiaWE Review.