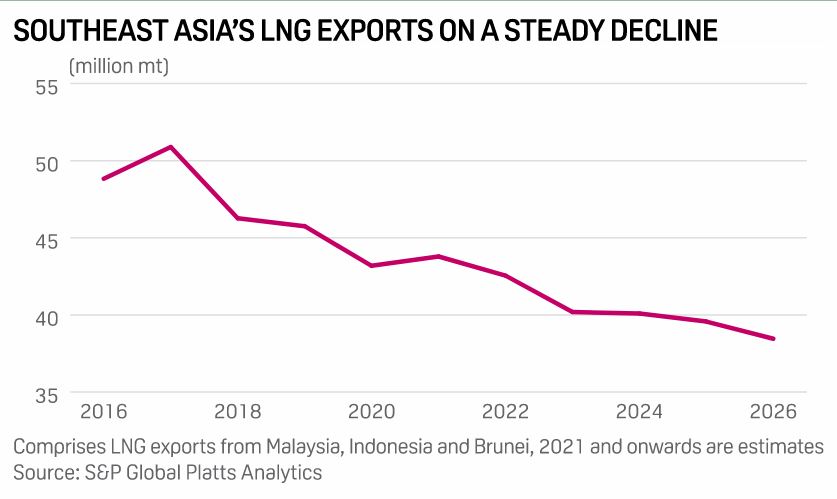

Underinvestment in Southeast Asia’s upstream sector and steady declines in mature oil and gas fields are impacting the region’s top natural gas producers, forcing LNG exporters to cut back on supply to top customers in North Asia, most recently for cargoes in peak winter.

The speed at which new gas fields can be brought online was already hampered by resource nationalization policies and the withdrawal of international oil majors, leaving national oil companies like Malaysia’s Petronas, Indonesia’s Pertamina and Thailand’s PTTEP to deal with the uphill task of maintaining energy security.

New gas production is now further challenged by the backlash against fossil fuels, as financial institutions make it harder to fund exploration and production, and new gas fields are delayed by the need for investment in carbon capture and storage to offset the large CO2 content of these assets.

“I’ll be the one to put my neck out and say any large LNG project which wants to get onto the design stage today has to come with carbon capture,” Siddhartha Shrivastava, Head of Energy and Resources for Asia at Sumitomo Mitsui Banking Corp., said at S&P Global Platts’ Asia LNG & Hydrogen Conference in October.

Such issues hinder Southeast Asia’s ability to meet Asia’s LNG demand and its own domestic gas needs, while increasing the dependence of large gas-dependent economies like China, Japan and South Korea on long-haul suppliers like the US and Atlantic basin LNG exporters. Supply shortages in peak winter demand periods have contributed to an energy crisis and record high gas prices.

Malaysia, Indonesia and Brunei account for around 12% of the world’s LNG exports and nearly a third of the LNG produced in Asia-Pacific, dwarfed only by Australia. Papua New Guinea is the other big LNG exporter in the region. In comparison, Southeast Asia’s combined proved gas reserves, including non-LNG exporting countries like Myanmar and Vietnam, are larger than Australia’s, leaving much energy export potential untapped.

Customer impact

Until 2017, Japan was the single-largest destination for Southeast Asia’s LNG exports, but China has rapidly increased its share in recent years and is set to become the region’s largest customer by the end of 2021.

However, Southeast Asia collectively remains Japan’s second-largest LNG supplier after Australia, and Japanese utilities generally import more LNG from Malaysia every year than Qatar, the world’s largest LNG exporter.

Japanese importers, which have term contracts with national oil company Petronas, have received notices of cancellation and deferral of LNG cargoes scheduled for winter, and discussions are still underway on the extent of the downward quantity tolerances or DQTs, which are supply cuts that can be legally accommodated in sale and purchase contracts.

“[The] DQT that was reported is part of the contract that is usually negotiated and agreed with the customers. We are negotiating that and there will be re-timing and rescheduling of the deliveries that will be agreed with the customers,” Petronas President and Group CEO Tengku Muhammad Taufik, said at the ADIPEC conference in Abu Dhabi recently. He did not answer further questions.

But the supply issues have already prompted Japanese importers to review their winter procurement and consider contingency plans. This includes assessing the need for spot LNG cargoes, seek alternative suppliers and review shipping schedules for winter, with at least one importer of Malaysian LNG saying that spot LNG purchases at current price levels would be a last resort.

Japanese importers also expressed disappointment at Petronas’ sales of spot LNG cargoes from Malaysia’s floating LNG facility and Gladstone in Australia while it was exercising supply cuts to contracted customers.

S&P Global Platts data shows multiple spot sales of LNG by Petronas for loading from Australia and its FLNG in Malaysia in November and December, at relatively high prices of over $30/MMBtu. Petronas is not under any obligation to divert spot cargoes to its term customers, but traders said it is not unusual for producers to optimize portfolios to maintain business relationships.

In spite of Malaysian LNG supply concerns, Japan should still have secured sufficient LNG inventories for this winter unless the country experiences severe cold spells, a market source tracking the Malaysian situation said. End-October LNG inventories stood at 2.07 million mt, remaining above the highest level in the last five years, but down from 2.46 million mt at end September, government documents showed.

Long-term dependency

Southeast Asia’s declining production could prompt a more strategic assessment of long-term dependency by its Asian customers, especially with competing supply emerging from Australian brownfields to the Russian Arctic.

This reassessment could easily feed into upcoming negotiations as contracts expire, both for suppliers and for Japan. The country’s largest utility JERA’s recent move to boost equity offtake from US-based Freeport LNG is an example of strategic supply realignment.

“Platts Analytics calculates that Petronas has roughly 6 million mt/year of contracts scheduled to expire by the end of 2025, many of which are likely to face some form of renegotiation in the coming years,” Jeff Moore, Manager, Asian LNG Analytics at S&P Global Platts, said.

“Several of these contracts were signed as extensions of original contracts underpinning the liquefaction trains at Bintulu. During their most-recent re-signings, often they were extended several years before the contract expired, showcasing how the current supply issues could put some of these re-signings at risk,” Moore said.

Source: spglobal